Significant changes to Medicare Part D are on the horizon, building on the foundation set by the Inflation Reduction Act. The Centers for Medicare & Medicaid Services (CMS) has outlined several key adjustments that will impact prescription drug costs for millions of beneficiaries.

Understanding these 2026 Medicare Part D changes now is the best way to prepare for the upcoming Open Enrollment season. These modifications build on the prescription drug plan changes from 2025 and will impact out-of-pocket costs and premiums for millions of people with Medicare Part D. Here are the key details you need to know.

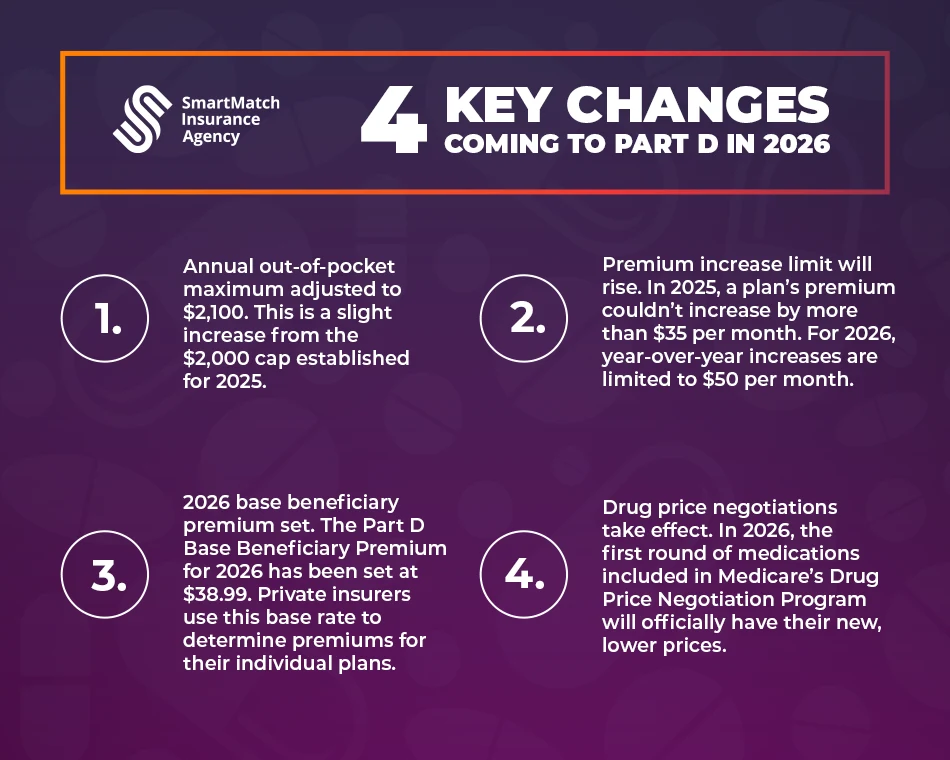

For 2026, the maximum out-of-pocket (OOP) spending limit for Part D beneficiaries will be adjusted to $2,100. This is a slight increase from the $2,000 cap established for 2025. Knowing this number is a key part of planning your healthcare budget for the year ahead.

CMS is adjusting the rules around how much a plan’s total Part D premium can increase from one year to the next.

CMS made this decision after carefully testing the more restrictive limit in 2025. This information empowers you to understand potential premium changes when you’re comparing your plan options for the upcoming year.

Important Note that while the amount that a plan premium can increase is limited to this $50 threshold, this does not stop insurance carriers from discontinuing or cross-walking plans to a higher premium plan. So be sure to review your ANOC closely for this.

The Part D Base Beneficiary Premium for 2026 has been set at $38.99. As part of the Inflation Reduction Act, Medicare Part D changes include a rule that this base premium cannot increase by more than 6% per year which helps keep costs predictable.

It’s helpful to think of this as the starting point. Private insurance companies use this base figure to set the specific premiums for their individual plans. While your own premium will depend on the plan you choose, this base rate is a crucial part of the overall cost structure.

In 2026, the first round of medications included in Medicare’s Drug Price Negotiation Program will officially have their new, lower prices take effect. This is a landmark program aimed at making essential medications more affordable, and it’s expected to deliver significant savings on several widely used drugs. You can learn more about how Medicare negotiated prices will lead to savings here.

While these are the initial parameters for the 2026 Medicare Part D changes, more information is on the way. This September, CMS is expected to release the final number of Part D plans that will be available and the national average for monthly premiums. Staying informed is the best way to prepare for Open Enrollment and choose the plan that’s right for you. We’ll be here to share the latest updates as soon as they are available, so please stay tuned.

Find your personalized Medicare recommendation in just 2 minutes

Question 1 of 10

Please log in to view assigned tenants.