Medicare Advantage plans offer a variety of supplemental benefits, which can sometimes lead to confusion. Two benefits that are frequently compared are Over-the-Counter (OTC) benefits vs. grocery allowances. While both aim to support members’ well-being, they serve different purposes and have key distinctions.

As we’ve discussed in Part I, OTC benefits provide an allowance for purchasing health-related over-the-counter products. These benefits are designed to help members manage their health and wellness by providing access to items like pain relievers, cold and flu remedies, and first-aid supplies. OTC benefits are a common feature in many Medicare Advantage plans.

Grocery allowances, also called the health foods benefit, are a different type of benefit with a more specific focus. These stipends are typically offered through Special Needs Plans (SNPs). SNPs are a type of Medicare Advantage plan designed to serve individuals with specific needs, such as:

Grocery allowances aim to address food insecurity and promote healthy eating among these vulnerable populations. They provide an allowance that can be used to purchase eligible food items, such as:

The specific food items allowed will vary by plan, but the focus is generally on providing access to healthy and essential food choices.

How a Medicare grocery allowance works depends on your insurance carrier and plan. In many cases, D-SNPs provide flex spending cards that you can use like a debit card. These cards are typically preloaded on a monthly or quarterly basis.

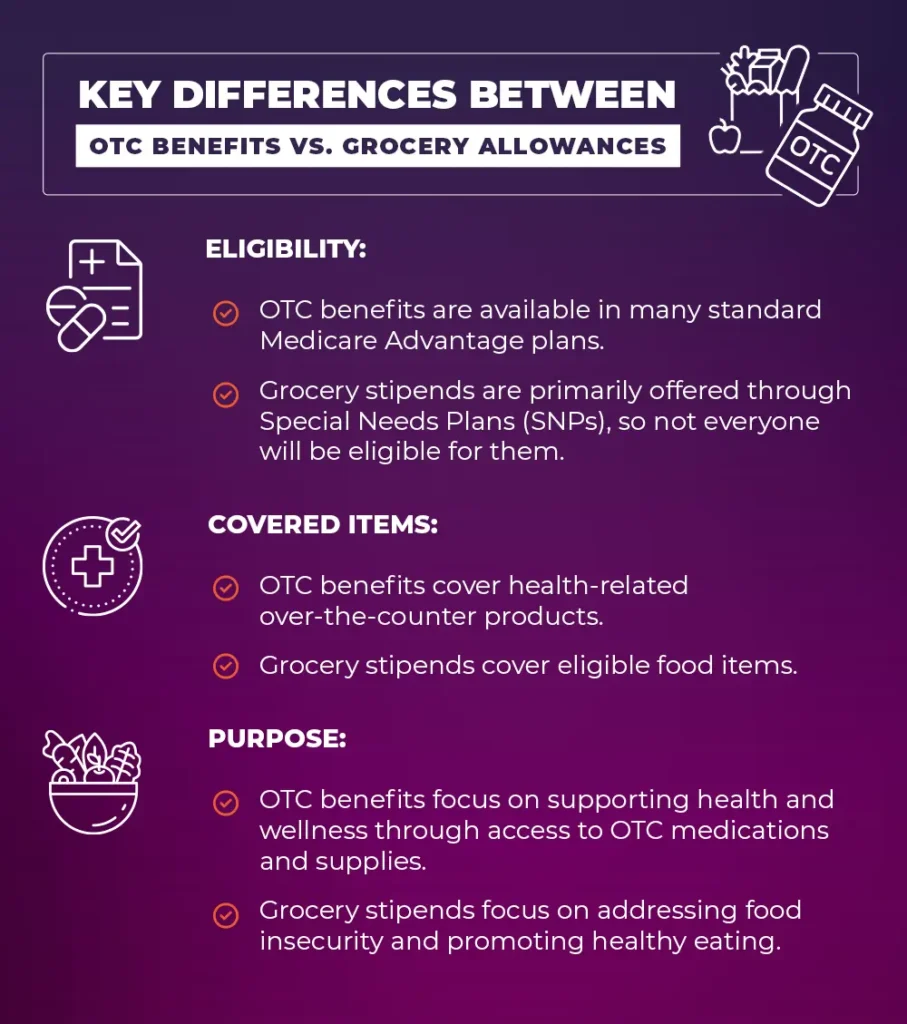

Here’s a breakdown of the key differences between OTC benefits and grocery stipends:

It’s important to understand these distinctions when evaluating Medicare Advantage plans. If you have specific needs related to food insecurity and a qualifying condition, a Special Needs Plan with grocery stipends might be a valuable option. If you’re looking for assistance with everyday health and wellness expenses, a Medicare Advantage plan with OTC benefits could be a good fit.

*Disclaimer:

The information provided in this blog post is intended for general informational purposes only and does not constitute medical advice. It is not a substitute for professional medical consultation or treatment. Always consult with a qualified healthcare provider for any questions you may have regarding a medical condition.

SmartMatch does not endorse or recommend any specific products, treatments, or procedures mentioned in this article. Reliance on any information provided in this blog post is solely at your own risk. We encourage you to discuss any health concerns or questions with your doctor before making any decisions about your health or treatment.

Find your personalized Medicare recommendation in just 2 minutes

Question 1 of 10

Please log in to view assigned tenants.