As a Medicare beneficiary, your mailbox will soon deliver a crucial document: the Annual Notice of Change (ANOC). Sent by your Medicare Advantage (Part C) or Prescription Drug (Part D) plan each September, your ANOC is not junk mail. In fact, it’s your essential guide to understanding how your Medicare benefits and coverage will change for the upcoming year, directly impacting your choices during the Medicare Annual Enrollment Period also known as Medicare Open Enrollment Period.

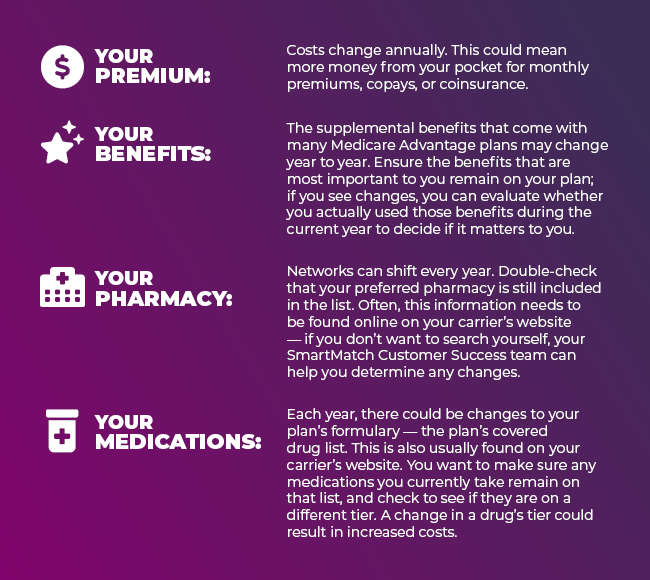

The Annual Notice of Change letter is sent by your insurance company to detail any changes to your Medicare Advantage plan or Medicare Part D plan that will go into effect in January. You should use the ANOC to evaluate if your plan is still the right fit for you or if it’s time for a change in coverage. The changes consist of four main topics:

This article highlights four key questions to ask when you’re reviewing your ANOC.

Your plan premium, co-pays, out-of-pocket maximums and deductibles are all the amounts you are responsible for your Medicare Advantage plan or Part D plan. A higher premium or out-of-pocket maximum could significantly impact your healthcare budget. Insurance companies typically update their premiums annually. The ANOC will notify you if there has been an increase in your monthly premium for the coming year, any changes to out-of-pocket costs, and deductibles.

If the total of the new premium and out-of-pocket maximum is more than you’re comfortable with, you might want to reconsider your health care coverage. You can likely find a similar plan at a lower monthly cost, or you can find more comprehensive coverage for a comparable premium.

Additionally, the ANOC will tell you whether your specific medications are still covered, if they have changed tiers, or if they have been removed from your plan’s covered drug list. This Medicare formulary may look intimidating, but it details the drugs that are covered in your drug plan.

The ANOC also includes medications that have been added to your plan’s coverage and indicates any changes in copayments or coinsurance rates — a higher tier means higher cost-sharing — for the prescriptions they cover.

Don’t forget to review changes to your plan’s network to ensure your preferred provider or pharmacy is still included. If the pharmacy you use leaves your plan’s network or stops offering preferred cost-sharing, you can typically find a new pharmacy nearby within your plan’s network. If you do not wish to change pharmacies, you may need to change your Medicare plan instead.

Similarly, you’ll want to check that your doctors are still included in your plan’s network. If not, you’ll want to consider changing doctors or changing plans.

Not all plans are available in all states. Although insurance companies rarely stop covering large geographic areas, you’ll still want to verify your inclusion (especially if you live in a rural area). If your area is no longer included, you need to find a new plan for the upcoming year.

Once you understand the key components of the ANOC, you’ll be able to evaluate if your current plan is still right for you. However, there might be other changes in your needs that merit plan comparison for the upcoming year, such as financial changes, health changes or lifestyle changes. This is where the Medicare Annual Enrollment Period (AEP) comes in. From October 15th to December 7th, you have the opportunity to switch Medicare Advantage plans, enroll in a Part D plan, or change your existing Medicare plan based on your ANOC review and any financial changes, health changes, or lifestyle changes.

LEARN MORE: How To Know If I Should Change My Medicare Plan?

Your Medicare Annual Notice of Change (ANOC), arriving each September, is more than just a letter; it’s your personalized roadmap to understanding your Medicare coverage for the year ahead. By carefully reviewing changes to your Medicare premiums, prescription drug coverage, and provider networks, you empower yourself to make informed decisions.

Don’t wait! Use the insights from your ANOC to evaluate if your current Medicare Advantage plan or Medicare Part D plan still meets your needs. The Medicare Annual Enrollment Period (AEP), running from October 15th to December 7th, is your dedicated time to compare Medicare plans and make changes. Ensure your Medicare benefits align with your health and financial goals.

Please log in to view assigned tenants.